Ninth week of Seema Kaushik’s Portfolio Building

In this part of the blog, we will see what happened between 17th August 2017 to 23rd August 2017.

If you are new here and haven’t read the first part of this story, I would suggest and request you to go to the first part for the better understanding of the story. Link is provided below:-

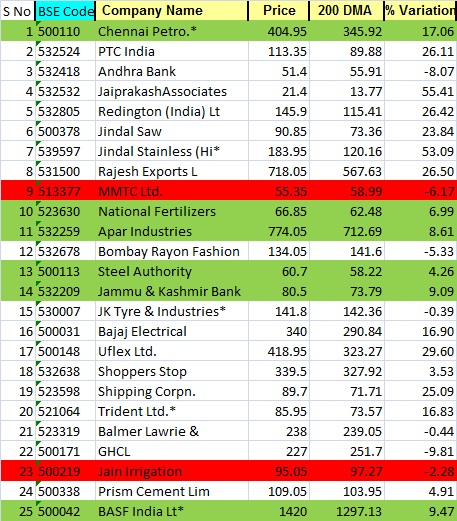

This week, on August 23, 2017, the share ranked 25; BASF India Ltd was trading 9.47% above of its 200 DMA, See in the picture below: -

We have already purchased the stocks which are marked in green; those marked red are being entered in the reverse trading system. Those who are interested in knowing more about the reverse trading system may read the eighth-week story, link is given below

So on August 23, we invested 7153.84 rupees by purchasing 7 shares of the BASF India Ltd which was ranked at 25. A snapshot of the trade book is provided below:-

Post closure of the market on 23rd Aug 2017, Seema's Balance sheet was as follows:-

Although we have sold Chennai Petroleum shares on August 24, at 419.50, we have booked profits of around Rs. 1200, but according to the rules, they will be shown in next week's story. This week my mutual fund blog has also been updated that you can read from the following link: -

Links of Data Bank and Multibagger Stokes 2018 will also be updated in a couple of days. You can understand my situation that I am not a company where many personnel are working, All the work has to be done by myself and it requires time for accuracy and presentation

Today I would also like to tell you what activities keep me busy:-

1. I am a Revenue Accountant, and it requires full-time services

2. After going home from Tahsil, I check 20-30 shares per day so that I can find new shares, Sometimes I am fatigued and can't-do it.

3. I am working on my coming Hindi Book “Kese Pahunch Abdul Stock Market Ke Shunya Se Shikar Tak," currently I have completed 62 pages and estimated the length of this book is around 250 pages.( Of course after publishing in Hindi, English translation of this 4th book will also be provided.)

4. I also work to update my data bank.

5. I also try to read the e-mails and answer to blog and YouTube comments.

6. I am an avid reader as well. I keep looking for new books to read. I have finished a new book "Jivatma Jagat ke niyam" in Hindi. It is a good read where souls are explaining what happens after death.

The Link to the book is given below:-

7. I watch "Tenalirama," " Tarak Mehta ka Ulta Chashma," and "Sajjan Re, Jhooth mat Bolo" in the evening, Even while watching TV, I am busy on my laptop for researching new share and replying to comments.

8. I also help seema in her Seema’s Rasoi blog in the uploading of his videos etc.

Tenth week of Seema Kaushik’s Portfolio Building

In this section, you will be told the story from August 24 to August 30. Actually, we have scheduled to buy stock on every Wednesday.

If you are new here and haven’t read the first part of this story, I would suggest and request you to go to the first part for a better understanding of the story. Link is provided below:-

This week, on August 24, 2017, our portfolio had shares of Chennai petroleum which we had purchased on 28th June 2017 at a price of 349, and we were making a profit of 20% on it which is Rs. 69.80 profit and in that case, we had to sell our shares at 418.80, but on 25th August the market price was 419.15 so Seema sold 18 shares and made a net profit of 1157.07 after brokerage and other charges. If you have gone through previous week's stories, you would be aware of the dividend of 378 which Seema got on these shares.

This week, after selling the shares of Chennai Petro, we got Rs 7486.56 after reducing brokerage and tax, so there was no need to invest any new funds to buy shares this week.

Trade Book of Chennai Petro:-

Some readers may say that Chennai Petro rose more than 419 after we sold it. I would say don't regret it as we have fixed a 20% profit cap and after getting it, we invested the amount in Shopper's Stop Ltd. which also increased.

Shoppers Stop Ltd's stock was trading 8% above its 200 DMA this week: -

Therefore, we bought 18 shares of Shoppers Stop at 355.25 and invested 6442.99 including brokerage and tax, Look in this trade book: -

After the closure of the market at - 30th August 2017 at 6.00 p.m. the balance sheet of Seema was as follows:

If you have not seen my new video, then see this link:

Eleventh week of Seema Kaushik’s Portfolio Building

In this section, you will be told the story from August 31 to September 6th. Actually, we have scheduled to buy stock on every Wednesday.

If you are new here and haven’t read the first part of this story, I would suggest and request you to go to the first part for better understanding of the story. Link is provided below:-

On September 5 this week, the stock of Jain Irrigation closed at 104.10, which closed above 5% of its 200 DMA 97.27.You remember, Seema Kaushik bought 59 shares of Jain Irrigation at the price of 108.10 on July 23, 2017.

If you have forgotten, then read the fourth part of the series by visiting this link:

But unfortunately, the stock of Jain Irrigation closed on August 10, 2017, below 5 percent of its 200 DMA, so Seema Kaushik had sold her 59 shares at 91.95 and booked a loss of Rs 1048.37, but it was actually loss booking but trading with the reverse trading system. I have explained it in detail in the 8th week. Read it again to refresh.

Link to 8th week

Now the time has come that we should buy back shares of Jain Irrigation sold by the reverse trading system, So on September 6, Seema bought back 59 shares of Jain Irrigation at 104.10 rupees, this time only Rs 6190.29 had to be invested. Check the trade book:

This does not mean that we will not buy new shares this week. Buying shares of Jain Irrigation are not same as buying new shares. In a way, we had held in indirectly in our portfolio.

Selling in reverse trading, i.e., holding indirectly.

If you did not understand clearly, then I will narrate a story.

This story is written by the famous writer Robert Kiyosaki. In his book, Robert Kiyosaki writes that if there are 20 shares in my portfolio, only 2 -3 shares act as hunter dogs and get me the prey, i.e., at a time in a portfolio of 20-30 shares only 2-3 shares will gain, rest will be like lazy dogs, i.e. showing bound movement, going up and down by Rs. 10 alternatively. But when these lazy dogs start biting, that means the shares go down too much, then I take them out.You can see Roberts Kiyosky's books on the following link:

Similarly, Jain Irrigation was like a lazy dog to us, but we see it is again turning out to be a hunter again, so we take it back.

What should be our target now?

Earlier, we had taken 59 shares of Jain Irrigation with the price of 108.10, then our target would be to sell them at 20% above the price, ie, 129.72, but what will be our target now, will this new purchase price be 104.10 to 20% above?

No!

Why Not?

Because what will be the meaning of Reverse trading system, the loss we booked has to be added to the target, i.e. 1048.37 will be divided by 59 and thus the loss of 17.77 booked per share will have to be added to the target.

i.e.

Now, we sell 59 shares of Jain Irrigation from 104.10 to 20% above the price of Rs. 124.92 and 17.77 for 142.69 per share, we will get 20 percent profit from this trade and will cover up the loss of 1048.37 for the reverse trading system.So the reverse trading system has made it 142.69 per share by increasing our previous target of129.72 by 13 Rupees.

See what happens ahead

This week's shares ranked at 26 was HSIL, and it was trading at 14.98% above its 200 DMA, we purchased 17 shares of HSIL at a price of 381.95 an investment of 6573.15 including brokerage and taxes. See it in the trade book below:-

So this week 6 September 2017 the balance sheet of Seema was as follows:-

Twelfth week of Seema Kaushik’s Portfolio Building

In this section, you will be told the story from September 7th to 13th September. Actually, we have scheduled to buy stock on every Wednesday

If you are new here and haven’t read the first part of this story, I would suggest and request you to go to the first part for the better understanding of the story. Link is provided below:-

This week on 11th September, our Shoppers Stop shares which we had purchased on 30th August gained 20% profit in mere 12 days. Seema sold and booked a profit of 1187.68 and the same may be seen in the trade book:-

As you can see, 41 Shares of HT Media has been sold at 101.75, you may think that when did we purchase these shares as nothing was told about this in the Book, so when did I purchase and sell it

My regular followers here use my App and they may have it in mind that I had recommended HT Media shares priced at 82, and I am also following my own recommendations, so my wife and I both invest in those shares which we recommend to you.

Therefore, my wife also bought HT Media shares and earned profits with Shoppers Stop.

When my stated shares are recommended for one year or three to six months and they do not gain for two months then I get comments like this; Have a look!

Comment: - Sir, this time you’re told shares did not gain as fast as they used to run before, you have looted me sir.

The response of the another follower on this comment: - Brother, Mahesh Kaushik has earned money from us by selling his books, and he has left us in the middle of the lurch, most of his recommendation has failed, and he has run away from the stock market. So do not make anyone a guru, Use your brains

My reply to that comment: - I have not fled (run away) from the share market and am pretty much alive, neither have I looted you. Why do you invest huge capital for short duration, also why don’t you use reverse trading system. And also, my recommendation hasn’t failed and I am holding all the shares recommended by me. For the followers who have little patience and are in habit of investing larger capital amount, I have suggested Reverse Trading; Also I don't even put Stop loss. Regarding the Books, It’s the publishers selling the book and I earn some royalty from that, I am not writing books to earn royalty but to help small investors and to educate them. Keep patience, everything will be okay.

And you can see, HT media shares everything turned out to be good.

Enough of the comments story, This Wednesday we didn't have to invest in share market as after selling Shoppers Stop shares were-invested that money in purchasing shares this week. Upon checking the 200 DMA in the book this was seen:-

Yellow colored shares indicate that Profit has been booked and after July 2018, in the new edition of the book it will be analysed if they make in the ranking list.

Green ones are on Hold with us.

Red ones are under reverse trading system and hypothetically they are on a hold. Whenever they will close on 5 % above 200 DMA, we will buy them back.

You must have seen, share ranked 15 of JK Tyres was trading 7.50 % above 200 DMA, Thus we bought 41 shares of JK Tyres priced at 154.50. It may be seen in the Trade Book:-

After the market closure on September 13, 2017, see the balance sheet:

If you have not seen my new videos then go to this link and see:

Your comments increase my enthusiasm and negative comments will improve me, so irrespective of wether I reply or not, there should be no laxity in commenting from your end.

Regards

Mahesh Kaushik

Next Part:-

Next Part:-